The SIE is a huge departure in that for the first time, FINRA will be allowing individuals who are not associated with financial firms to take the exam.

Unlike traditional securities exams that require an individual to be an employee of a sponsoring firm, the SIE Exam allows university students and career changers to take the exam without sponsorship.

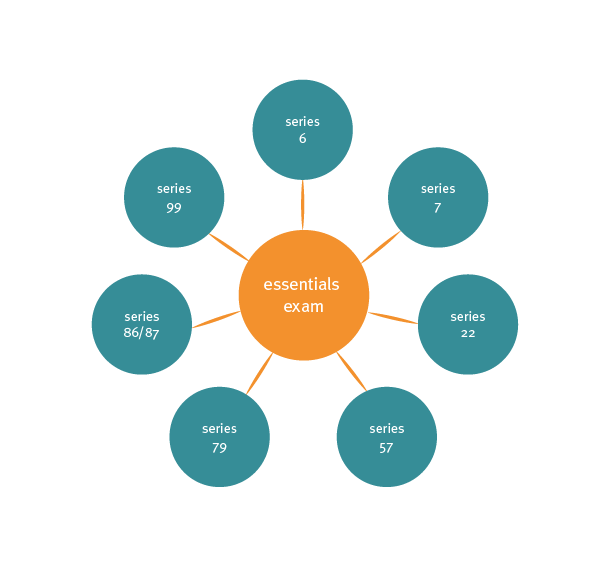

Another difference between the SIE and traditional FINRA exams, is that the SIE Exam will not allow an individual to perform a particular function, but will instead serve as a prerequisite for taking additional “top-off” exams in their desired area of expertise, a little like a foundation course before launching into a degree.

A combination of the SIE Exam plus a top-off exam will be equivalent to the securities exams currently being offered (e.g. Series 6, 7, 57, or 79).

How Can Firms Benefit from the SIE?

Watch a video explaining the benefits.

How Can Individuals Benefit from the SIE?

Watch a video explaining the benefits.

75 multiple-choice questions.

Plus 10 additional, unidentified pre-test questions which will not count towards a candidate’s score.

Time allotted – One hour and 45 minutes (105 minutes) to complete the exam.

Examination fee is £90 plus delivery.

Passing score of 70%

Four sections in exam:

We expect the exam to be challenging and require candidates to have an understanding of many different aspects of the securities industry.

Exam Passing Score Cost of materials

| Exam

SIE |

Passing Score

70% |

FINRA Exam Charge

£45 |

| Series 6 | 70% | £35 |

| Series 7 | 72% | £190 |

| Series 52 | 70% | £85 |

| Series 57 | 70% | £46 |

| Series 79 | 73% | £190 |

| Series 86 | 73% | £145 |

| Series 87 | 74% | £100 |

| Series 99 | 68% | £35 |

Everything you need to know to launch your financial services career.

How will the SIE benefit your employees?